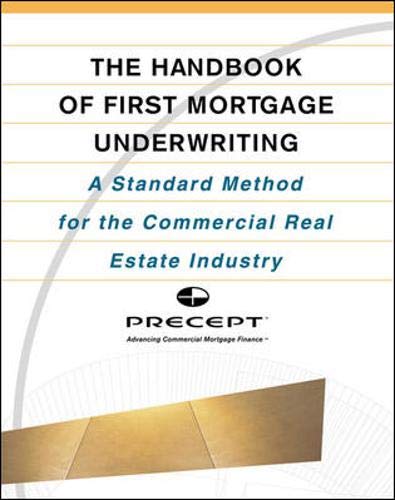

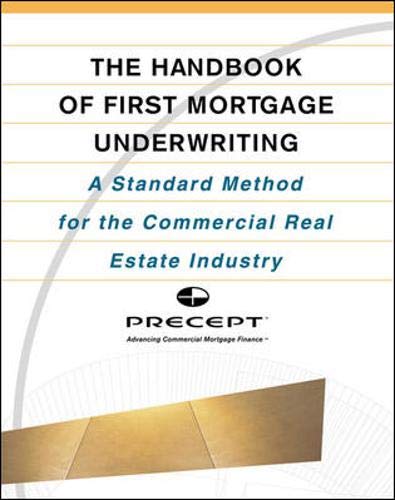

The Handbook of First Mortgage Underwriting : A Standard Method for the Commercial Real Estate Industry

$86.49

| Brand | Precept Corp |

| Merchant | Amazon |

| Category | Books |

| Availability | In Stock Scarce |

| SKU | 0071388877 |

| Age Group | ADULT |

| Condition | NEW |

| Gender | UNISEX |

| Google Product Category | Media > Books |

| Product Type | Books > Subjects > Business & Money > Personal Finance > Credit Ratings & Repair |

About this item

The Handbook of First Mortgage Underwriting : A Standard Method for the Commercial Real Estate Industry

The Handbook of First Mortgage Underwriting details the foundation for a revolutionary new commercial mortgage underwriting process. The first true industry breakthrough in years, it brings tremendous savings of time, effort, and cost by prescribing the first industrywide standards for underwriting commercial real estate. Includes: Easy-to-follow methods for cash-flow underwriting process and analysis - Standardized scopes of work for the property's site inspection - Guidelines for clear, concise presentation of the underwriting conclusions The First Uniform, Easy-to-Use Approach for the Underwriting of Commercial Real Estate Loans Perhaps once in a generation, a standardized financial system emerges that is so logical, so cost-effective, and so right that it deserves to be called revolutionary. Precept's The Handbook of First Mortgage Underwriting is an essential component to just such a system. Discover why today's most prominent lenders have embraced it, and why it is destined to become the methodology used and accepted by the commercial real estate industry. Industry praise for Precept's The Handbook of First Mortgage Underwriting : "Precept's underwriting standards are driving analytical transparency on behalf of the commercial real estate finance community." --Jack Cohen, Cohen Financial "Precept is producing some of the highest quality underwriting analysis in the industry today. This is their blueprint." --John Westerfield, Morgan Stanley "This book distills the sorts of insights and experience that can only be gained by thorough credit analysis of tens of billions of loans on all types of income producing property." --Dan Bober, Bloomfield Acceptance Company "This manual is the articulation of a single set of standard for the collection, validation and analysis of the information necessary to underwrite commercial real estate debt. It provides real estate professionals, who have a working knowledge of lending issues, with a framework that can be consistently applied to any lending situation." --From the Introduction Commercial real estate underwriting often follows a classic "cart before the horse" system. Borrowers and their brokers initiate loan applications with one, or often several, lenders, who in turn present "soft," non-binding quotes. If accepted by the borrower, these are then authenticated only after exhaustive due diligence and evaluations. It is efficient for neither party and needlessly time-consuming and costly for both. Precept's The Handbook of First Mortgage Underwriting details the foundation for an entirely new approach, one that standardizes and legitimizes the commercial real estate underwriting process with a single set of rules that shapes, clarifies, and simplifies each step. The first comprehensive, uniform set of underwriting guidelines for commercial property, it describes steps any lender can adopt to facilitate: Data Collection-- Rules on exactly what information must be gathered, with a standardized form to record the information - Validation-- Guidelines as to which data should be validated, and precisely why and how this should occur - Analysis-- A specific underwriting methodology that guides how lenders and third parties should analyze cash flows, credit, and more - Presentation-- Logical categories for summarizing and reviewing information, and tracking conclusions back to their underlying data - Third Party Reports-- Directions on what they should contain, and how they should be conducted and used by the underwriter The Handbook of First Mortgage Underwriting outlines a rigid, straightforward underwriting process, one that creates a consistent process for collecting, analyzing, and summarizing available data. Featuring numerous forms, checklists, and examples, it contains everything required for a complete presentation of the underwriting conclusions to clearly highlight any credit or collateral issues. Precept is today's most important and influential electronic commercial mortgage exchange. Backed by many of Wall Street's leading firms, and working in partnership with Standard & Poor's, it stands at the forefront of commercial mortgage origination, underwriting, placement, and securitization.

| Brand | Precept Corp |

| Merchant | Amazon |

| Category | Books |

| Availability | In Stock Scarce |

| SKU | 0071388877 |

| Age Group | ADULT |

| Condition | NEW |

| Gender | UNISEX |

| Google Product Category | Media > Books |

| Product Type | Books > Subjects > Business & Money > Personal Finance > Credit Ratings & Repair |

Compare with similar items

The Big Book of Maldives Facts: An Educa... |

When Night Steals the Sky... |

I Remember Nothing: and Other Reflection... |

The House of Plant of Macon, Georgia: Wi... |

|

|---|---|---|---|---|

| Price | $13.99 | $24.99 | $39.95 | $30.48 |

| Brand | James K. Mahi | Kyle R Malfa | Nora Ephron | G. S. Dickerman |

| Merchant | Amazon | Amazon | Amazon | Amazon |

| Availability | In Stock | In Stock | In Stock Scarce | In Stock |